Happening at Tampa REIA

Live In Person & Online Meetings

In Today’s Tampa REIA Update:

- WED: Tampa/Clearwater Meetup Group at Rudy’s Sports Bar in Largo (New Location)

- Every WED 7PM: Property Protege Group (PPG) Coaching Meets on Zoom Webinar

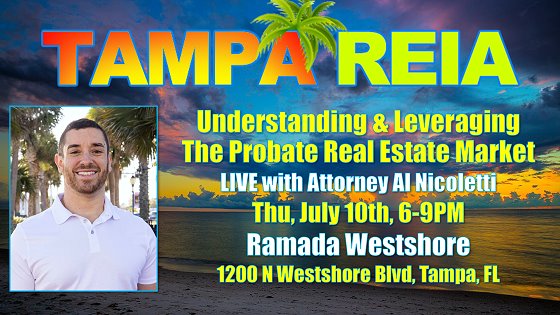

- THU: Tampa REIA with Probate Attorney Al Nicoletti

- THU: Late Night Networking at World of Beer

- Webinar Replay with Jay Conner on “How to Raise Private Money Without Asking For It” for a Limited Time Only!

- Webinar Replay with Bill Twyford on “7 Steps to a 7-Figure Real Estate Income ” for a Limited Time Only!

- Our Facebook Groups for Posting & Finding Deals

Wed, July 9th at 11:30AM in Largo

Wednesday, July 9th @ 11:30AM (Live in Largo): The Tampa Clearwater Real Estate Group, hosted by James Miera, meets at Rudy’s Sports Bar, 11100 66th St N, Largo, FL 33773 on the 2nd Wednesday of each month. Come join us LIVE & In-Person for food, drinks, networking, education and fun!

Wednesday, July 9th @ 11:30AM (Live in Largo): The Tampa Clearwater Real Estate Group, hosted by James Miera, meets at Rudy’s Sports Bar, 11100 66th St N, Largo, FL 33773 on the 2nd Wednesday of each month. Come join us LIVE & In-Person for food, drinks, networking, education and fun!

Thu, July 10th from 6PM-9PM LIVE in Tampa, FL

TAMPA REIA LIVE

Meeting & Vendor Tradeshow

Thu, July 10th, 6PM-9PM

Understanding & Leveraging The Probate Real Estate Market

with Probate Attorney Al Nicoletti

Join us at the next Tampa REIA Main Meeting & Vendor Tradeshow on Thursday, July 10th from 6PM-9PM at the Ramada Westshore, 1200 N Westshore Blvd, Tampa, FL with Attorney Al Nicoletti. REGISTER NOW!

Join us at the next Tampa REIA Main Meeting & Vendor Tradeshow on Thursday, July 10th from 6PM-9PM at the Ramada Westshore, 1200 N Westshore Blvd, Tampa, FL with Attorney Al Nicoletti. REGISTER NOW!

Al Nicoletti is a Florida Probate Attorney extraordinaire. Al has carved out a unique niche in solving simple and complex probate matters that once stalled real estate deals. He developed a strategy to structure probates so they are fast, efficient, and done right.

Al’s law practice is strongly focused on Probate, Quiet Title, Partition, Trust Administration, Mortgage Foreclosure Defense, and Real Estate Litigation. He has a no-nonsense approach and is dedicated to positive quality results. The Law Offices of Al Nicoletti clients include real estate investors, developers, agents/brokers, estate executors, heirs, and more.

In addition to managing his law practice, Al hosts a live weekly podcast, is an educational speaker, and content creator. Al enjoys traveling nationwide to speak at real estate investor association meetings, boot camps, and masterminds to educate audiences on the potential of probate real estate.

At our July 10th Tampa REIA Meeting, Al will cover:

UNDERSTANDING & LEVERAGING THE PROBATE REAL ESTATE MARKET

Attendees will gain a comprehensive understanding of how probate works in Florida and learn strategies for effectively navigating this niche market.

HOW TO ANALYZE & VALUE Aa PROBATE PROPERTY

This presentation offers practical strategies for identifying opportunities and maximizing returns. Al provides actionable insights to capitalize on probate properties effectively and is for all levels of investors.

IDENTIFYING & RESOLVING TITLE ISSUES

This topics explores the complexities surrounding property titles. Al offers practical guidance on recognizing common title issues and strategies needed to ensure smoother transactions.

HOW TO GROW & MANAGE A HIGH VOLUME BUSINESS

Al offers his personal advice for scaling operations effectively and achieving long-term success. He shares key tactics for managing increased demand, optimizing workflows, and his strategy for navigating challenges.

RSVP below and join us at Tampa REIA on Thursday, July 10th at 6PM at the Ramada Westshore to get your probate real estate investing questions answered live and in person by Attorney Al Nicoletti!

Tampa REIA Members can attend at NO CHARGE. Not-Yet-Members can register online for $20 or pay $25 at the door. Register to attend In Person below.

RSVP to Attend in Person at https://rsvp.tampareia.com – This link is to attend in person at the Ramada Westshore. No charge for members, $20 for guests or $25 at the door.

Business members can RSVP for a Vendor Table here at https://vendor.tampareia.com. Vendor tables are available on a first come, first serve basis, so reserve your table now.

Call or Text Chrissy at 770-379-4501 if you have any questions. Thank you!

*Meeting Day Agenda

*Please Note: Meeting agenda is subject to change.

Monthly Vendor Trade Show

At 6:00 PM in the Meeting Room, we have a Vendor Trade Show that lasts throughout the meeting where you can come out and meet many of our participating Business Members and Vendor Guests who help sponsor our meeting.

At 6:00 PM in the Meeting Room, we have a Vendor Trade Show that lasts throughout the meeting where you can come out and meet many of our participating Business Members and Vendor Guests who help sponsor our meeting.

Vendor tables are limited, so any vendors wanting to reserve a table for the meeting can RSVP for a Vendor Table here. Vendor tables are reserved and setup on a first-come, first-serve basis.

What’s Happening at Tampa REIA

Starting at 6:30 PM, Dustin Griffin kicks off the Tampa REIA Main Monthly Event with updates and announcements. Dustin covers what’s happening at Tampa REIA in the upcoming weeks and months such as upcoming workshops, webcasts, special events, members benefits and much more!

Starting at 6:30 PM, Dustin Griffin kicks off the Tampa REIA Main Monthly Event with updates and announcements. Dustin covers what’s happening at Tampa REIA in the upcoming weeks and months such as upcoming workshops, webcasts, special events, members benefits and much more!

Haves & Wants Marketing Session

At 6:45 PM or so, we will be having the Haves & Wants Speed Marketing Session which gives our members the opportunity to quickly market deals they HAVE and to find deals they WANT. We also give our business members the opportunity to get up and say a few words about their businesses. Members who want to participate in the Haves & Wants Marketing Session must bring your flyers and get to the meeting early to get on our list of participants.

9:15 PM: Late Night Networking at World of Beer

Late Night Networking at World of Beer

After the conclusion of the Tampa REIA Main Meeting (around 9:30PM), we will be reconvening at the World of Beer located at 5311 Avion Park Dr, Tampa, FL for the “Meeting After the Meeting” with Tampa REIA Crew. Come eat, drink, network, have fun and hang out with us late into the night on Tampa Bay!

After the conclusion of the Tampa REIA Main Meeting (around 9:30PM), we will be reconvening at the World of Beer located at 5311 Avion Park Dr, Tampa, FL for the “Meeting After the Meeting” with Tampa REIA Crew. Come eat, drink, network, have fun and hang out with us late into the night on Tampa Bay!

Every Wednesday at 7PM on Zoom Webinar

Property Protege Group (PPG)

Every Wednesday at 7PM

Guests Can Attend 1st Time at NO CHARGE!

Join Us on Zoom Webinar

By Calling or Texting Chrissy at 770-379-4501

Every Wednesday @ 7PM: Join us at the Property Protege Group EVERY Wednesday at 7PM with Don DeRosa & Christine Griffin at Keller Williams, 1960 Satellite Blvd, Ste 1500, Duluth, GA. Those who cannot attend in-person can join us on Zoom Webinar. Just contact Chrissy for details at 770-379-4501.

Every Wednesday @ 7PM: Join us at the Property Protege Group EVERY Wednesday at 7PM with Don DeRosa & Christine Griffin at Keller Williams, 1960 Satellite Blvd, Ste 1500, Duluth, GA. Those who cannot attend in-person can join us on Zoom Webinar. Just contact Chrissy for details at 770-379-4501.

Are you interested in real estate investing? Come join us to learn how to analyze deals, explore different investment strategies, and network with like-minded individuals. Each week, we cover diverse topics in real estate to help you gain valuable insights and take the next step toward financial freedom.

Why Attend?

- Learn from experts and seasoned investors

- Get hands-on experience analyzing deals

- Network with aspiring and experienced investors

- Find answers to your real estate questions

Whether you’re a beginner or looking to sharpen your skills, this is the place to start!

Call or text Chrissy at 770-379-4501 for more information.

Watch Webinar Replay for a Limited Time Only

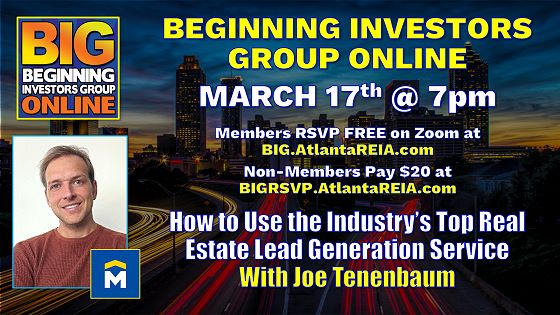

Beginning Investors Group Online

Recorded on May 19th at 7PM

How to Raise Private Money Without Asking For It!

with Jay Conner

Watch the Webinar Replay Now!

The Beginning Investors Group Online (BIGO) is meets ONLINE ONLY on the 3rd Monday of each month at 7PM on Zoom Webinar with your host, Dustin Griffin.

The Beginning Investors Group Online (BIGO) is meets ONLINE ONLY on the 3rd Monday of each month at 7PM on Zoom Webinar with your host, Dustin Griffin.

On Monday, May 19th at 7PM our special guest speaker was Jay Conner who was teaching us how to raise private money to fund our deals without having to ask for it. Watch the Webinar Replay Now to learn how!

Most investors think they need to ask for money. The pros don’t. They get it offered to them… because they know how to position the opportunity the right way.

This Monday, we are hosting a power-packed Beginning Investors Group with Jay that is designed to change the way you raise private money — without ever having to ask for it.

Imagine unlocking a floodgate of funding that lets you flip, wholesale, or hold more deals — all without touching your own cash.

This isn’t theory or fluff — it’s the exact strategy used by the top 1% of investors to secure unlimited, low-cost funding with zero pressure.

In less than an hour, you’ll get a step-by-step, proven system you can put into action immediately.

Plus, stick around for the live Q&A where Jay will answer your burning questions.

If you want to close more deals, maximize your leverage, and have the freedom to say YES the moment the perfect property appears — this training is a must-attend.

Don’t miss out — Watch the Webinar Replay Now!

Watch Webinar Replay for a Limited Time Only

Beginning Investors Group Online

Recorded on June 23rd at 7PM

7 Steps to a 7-Figure

Real Estate Income

with Bill Twyford

Watch the Webinar Replay Now!

The Beginning Investors Group Online (BIGO) is meets ONLINE ONLY on the 3rd Monday of each month at 7PM on Zoom Webinar. This month, on June 23rd at 7PM (Rescheduled Date), Dustin Griffin & Bill Twyford discussed “Seven Steps to a Seven-Figure Real Estate Income“

The Beginning Investors Group Online (BIGO) is meets ONLINE ONLY on the 3rd Monday of each month at 7PM on Zoom Webinar. This month, on June 23rd at 7PM (Rescheduled Date), Dustin Griffin & Bill Twyford discussed “Seven Steps to a Seven-Figure Real Estate Income“

Get ready for a no-fluff, high-impact training from one of the most dynamic voices in real estate investing — Bill Twyford, the Real Estate Rock Star! With over 1,000 deals under his belt and three decades of experience, Bill will reveal the exact seven steps he and his wife Dwan have used to build a seven-figure real estate business—and how you can duplicate it.

You’ll learn:

- How to buy properties and buildings with little to no money down

- The “secret sauce” to generating consistent monthly cash flow

- Direct-to-seller techniques that bring motivated sellers to you

- Real-world exit strategies you can use in today’s shifting market

- How to scale up without losing momentum

If you’ve ever thought, “How do I actually make a million dollars in real estate?” — this is your blueprint. Whether you’re brand new or looking to level up, this webinar will change the way you do business. Watch the Webinar Replay Now!

About Bill Twyford

Bill Twyford is a nationally recognized real estate investor, speaker, and trainer with 30+ years of experience and over 1,000 completed deals. He’s the co-founder of Investors Edge University, author of the best-selling book How to Sell Your House When It’s Worth Less Than the Mortgage, and a regular expert guest on NBC’s Colorado & Company. Bill is known for empowering investors with actionable strategies, direct-to-seller communication, and high-energy presentations that inspire real results.

Our Facebook Groups for Posting & Finding Deals

Do You Need More Deals or Have Deals You Need to Sell Fast? We Want ‘Em!

Post or Find Real Estate Deals on our Facebook Groups for Real Estate Investors at Florida Real Estate Investors Network, Tampa Real Estate Investors Network & Florida Wholesale Real Estate Deals and many more! See Full List of Facebook Groups.

Post or Find Real Estate Deals on our Facebook Groups for Real Estate Investors at Florida Real Estate Investors Network, Tampa Real Estate Investors Network & Florida Wholesale Real Estate Deals and many more! See Full List of Facebook Groups.

Tampa Real Estate Investors Alliance (Tampa REIA) is a Tampa Florida real estate investors association for real estate investors, real estate entrepreneurs and other real estate professionals who invest in Tampa real estate for fun and profit and are dedicated to the highest level of professionalism and integrity.

Tampa Real Estate Investors Alliance (Tampa REIA) is a Tampa Florida real estate investors association for real estate investors, real estate entrepreneurs and other real estate professionals who invest in Tampa real estate for fun and profit and are dedicated to the highest level of professionalism and integrity.

The

The  The

The  Post or Find Real Estate Deals on our

Post or Find Real Estate Deals on our  Hey Tampa Real Estate Investors, we have created a few new Facebook Groups for our Members, friends and followers to buy, sell and trade real estate or exchange things of value for real estate. These groups are also for sharing information and resources, asking questions and getting answers about real estate investing.

Hey Tampa Real Estate Investors, we have created a few new Facebook Groups for our Members, friends and followers to buy, sell and trade real estate or exchange things of value for real estate. These groups are also for sharing information and resources, asking questions and getting answers about real estate investing.

Join us at the next Tampa REIA Main Meeting & Vendor Tradeshow on Thursday, July 10th from 6PM-9PM at the

Join us at the next Tampa REIA Main Meeting & Vendor Tradeshow on Thursday, July 10th from 6PM-9PM at the  At 6:00 PM in the Meeting Room, we have a Vendor Trade Show that lasts throughout the meeting where you can come out and meet many of our participating Business Members and Vendor Guests who help sponsor our meeting.

At 6:00 PM in the Meeting Room, we have a Vendor Trade Show that lasts throughout the meeting where you can come out and meet many of our participating Business Members and Vendor Guests who help sponsor our meeting. Starting at 6:30 PM,

Starting at 6:30 PM,

The Tampa REIA Monthly Meeting for June is being postponed to July 10th with Al Nicoletti on Probate Investing. We are sorry to have to postpone, but several events occurred all at the same time which is making putting on a June meeting very difficult. But we will be back next week with the Beginning Investors Group and the Onsite Renovation Group.

The Tampa REIA Monthly Meeting for June is being postponed to July 10th with Al Nicoletti on Probate Investing. We are sorry to have to postpone, but several events occurred all at the same time which is making putting on a June meeting very difficult. But we will be back next week with the Beginning Investors Group and the Onsite Renovation Group.

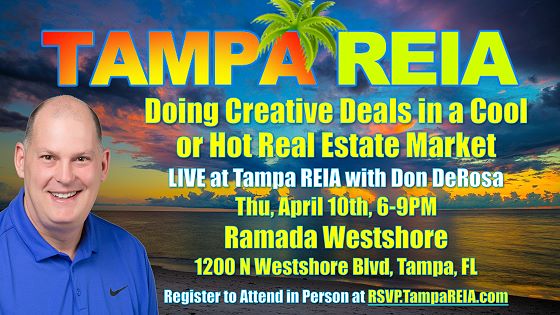

Are you ready to take your real estate investing game to the next level? Join us for an exclusive evening with Don DeRosa, one of the nation’s most respected real estate investors and educators at the Tampa REIA Main Meeting & Vendor Tradeshow on Thursday, May 8th from 6PM-9PM at the

Are you ready to take your real estate investing game to the next level? Join us for an exclusive evening with Don DeRosa, one of the nation’s most respected real estate investors and educators at the Tampa REIA Main Meeting & Vendor Tradeshow on Thursday, May 8th from 6PM-9PM at the

The

The