Tampa Real Estate Investors Alliance Blog

Never Forget 9-11-2001

Posted on September 11, 2013 by101+ Ways to Generate Motivated Buyer & Seller Leads Online Workshop – Session 1 Replay

Posted on September 6, 2013 by On September 6, 2013, Dustin Griffin kicked off the 101+ Ways to Generate Motivated Buyer & Seller Leads Online Workshop to teach you many of the 800 Pound Guerilla Marketing Strategies and Techniques he and other successful investors use to generate all the buyer and seller leads they can handle on a low budget and how you can too. For your convenience, this class is being offered online in 4 parts starting on Sept 6th with the other 3 parts taking place on Sept 13, 20 and 27.

On September 6, 2013, Dustin Griffin kicked off the 101+ Ways to Generate Motivated Buyer & Seller Leads Online Workshop to teach you many of the 800 Pound Guerilla Marketing Strategies and Techniques he and other successful investors use to generate all the buyer and seller leads they can handle on a low budget and how you can too. For your convenience, this class is being offered online in 4 parts starting on Sept 6th with the other 3 parts taking place on Sept 13, 20 and 27.

In Session #1, Dustin gave a detailed overview of the marketing process and covered “How to Market Your Real Estate Investing Business in 7 Easy Steps”. The purpose of this session was to teach attendees how to design a marketing plan to generate all the buyer and seller leads they desire, based on their own budget and short term and long term financial goals.

If you registered for this Online Workshop, you can login and watch the Workshop Replay below as well as see the class outline and download the Workshop Workbook, Worksheets and other Class Handouts. Read More→

The Profit September 2013 Edition

Posted on September 6, 2013 by The September 2013 edition of The Profit Newsletter is available for download just in time for our Tampa REIA Meeting on September 12th. You can download The Profit Newsletter as a High Quality PDF (Recommended) or Low Res PDF for slower devices. The Profit Newsletter is the official newsletter of the Tampa Real Estate Investors Alliance and is a digital, interactive newsletter for new and seasoned real estate investors delivered as an Adobe PDF file to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices with a PDF reader. Many of the articles and ads in The Profit contain hyperlinks you can click or tap to visit websites, watch videos, listen to audios, download content, send emails, comment on articles, share socially and much more! The high res version of The Profit is “print ready” for those who want to print the newsletter on their home or business printer. Also, be sure to Subscribe to The Profit so you don’t miss a single monthly issue.

The September 2013 edition of The Profit Newsletter is available for download just in time for our Tampa REIA Meeting on September 12th. You can download The Profit Newsletter as a High Quality PDF (Recommended) or Low Res PDF for slower devices. The Profit Newsletter is the official newsletter of the Tampa Real Estate Investors Alliance and is a digital, interactive newsletter for new and seasoned real estate investors delivered as an Adobe PDF file to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices with a PDF reader. Many of the articles and ads in The Profit contain hyperlinks you can click or tap to visit websites, watch videos, listen to audios, download content, send emails, comment on articles, share socially and much more! The high res version of The Profit is “print ready” for those who want to print the newsletter on their home or business printer. Also, be sure to Subscribe to The Profit so you don’t miss a single monthly issue.

What is Creative Deal Structuring and Financing?

Posted on September 6, 2013 by I’ve written a weekly real estate investing newspaper column for more than ten years. During this time, we’ve looked at all kinds of creative deal structures and financing…but what exactly are these?

I’ve written a weekly real estate investing newspaper column for more than ten years. During this time, we’ve looked at all kinds of creative deal structures and financing…but what exactly are these?

The easiest way to tell you what creative deal structuring is, is to tell you what it’s NOT. It’s not finding a house to buy at fair market value and then going to an institutional lender to get a traditional mortgage. That said, about everything else is creative deal structuring and financing.

The best deal structurer I know is Pete Fortunato. He has been one of our three primary real estate investing teachers since 1999. (The other two are Dyches Boddiford and Jack Miller.) Over the years, we’ve taken almost every seminar Pete has taught – every time he has taught it!

Much of our real estate investing knowledge comes from Pete. My biggest ah-hah Pete moment was seeing a picture of his Benefits House for the first time. These days, that picture hangs on the wall in front of my desk. Whenever considering a deal, I look at it and contemplate different ways the deal can be done. Read More→

Much of our real estate investing knowledge comes from Pete. My biggest ah-hah Pete moment was seeing a picture of his Benefits House for the first time. These days, that picture hangs on the wall in front of my desk. Whenever considering a deal, I look at it and contemplate different ways the deal can be done. Read More→

Determining Your Marketing Plan in 7 Easy Steps

Posted on September 6, 2013 by One of the things I have learned over the years about my ongoing marketing efforts is that my results only seem to be limited by how much time, effort and creativity I put into the marketing process and not how much money I spend. The more time and energy I put into the marketing of my real estate investment business, the better my results tend to be. When I decide to slack up, get lazy and not stick to my marketing plan, my results quickly diminish as a result.

One of the things I have learned over the years about my ongoing marketing efforts is that my results only seem to be limited by how much time, effort and creativity I put into the marketing process and not how much money I spend. The more time and energy I put into the marketing of my real estate investment business, the better my results tend to be. When I decide to slack up, get lazy and not stick to my marketing plan, my results quickly diminish as a result.

This is also true of the people I hire to market my business for me. Their success does not depend on how much I pay them, nor the size of their marketing budget, but how much time, energy and creativity they put into the marketing process.

Remember, 800 Pound Guerilla Marketing is about dominating your local market using a little time, effort, creativity and a relatively low budget using both new and traditional marketing techniques along with the power of the Internet. The more time, effort and creativity you put into the marketing process, the better your results should be.

As real estate investors, one of our most important responsibilities is to generate a steady flow of motivated buyer and seller leads for our business. After all, no leads = no deeds = no profits. If we don’t want to be responsible for personally generating leads ourselves, then we must hire someone competent to generate leads for us. But even if we do hire someone, it is still our responsibility to make sure they are generating the quantity and quality of leads we need to meet our business’s short term and long term financial goals.

If you want to generate all the leads you can handle for your real estate investing business, start by following these 7 easy steps to determine your marketing plan and your marketing budget: Read More→

How to Get a FREE Phone Number to Use in Your Business – Part 2

Posted on September 6, 2013 byWelcome back! Here’s what we covered in the last article: Why the PHONE is an essential element of your marketing and why there’s a big need for several different phone numbers for various reasons and functions for your business.

We also mentioned how having several phone numbers can add up to be an expensive ongoing cost that adds to your monthly overhead business expenses.

I then showed you an incredible FREE solution: Google Voice (GV)!

Finally, we talked about HOW to get your own GV number, and a few business applications & uses. Do you remember all that? If not, go back & re-read that article!

And if you haven’t already gotten your own Google Voice number, what are you waiting for? Go get it NOW – it’s FREE!

Here’s What We’re Going to Cover in THIS Article:

- A quick & easy shortcut to get to your GV options. This makes it really easy.

- A few secrets. You’ll need these.

- How to get SEVERAL Google Voice Numbers. Use ‘em for home or office!

- Some limitations (and how to overcome them).

- And finally… How to get a FREE home phone LINE (and number). Yes, it’s true!

So, let’s begin with this… Read More→

7 Deadly Mistakes You Can Avoid – Part 3

Posted on September 6, 2013 by(This article is continued from Part 2 in the August 2013 Edition of The Profit Newsletter.)

-

Lack of action. There’s an old saying that goes “Even a turtle won’t get anywhere until he sticks his neck out.” Another old saying (that I made up) is “You’re never going to get rich sitting on your behind and waiting for it to come to you.” You have to make it happen. You have to get things started. You have to put the wheels in motion. And if they get stopped, guess who has to get them started again. You guessed right.

Movement, action, activity, progress… they’re essential in any successful business. Without activity on your part, nothing positive will happen for you. It starts with that first call, that first conversation with a seller, even the first visit to a Realtor. But your ship can’t come in if it never gets launched.

By action, I don’t mean running in place. Sure, you can go to the seminars and listen to the tapes so often you memorize everything I’ve ever said. You can acquire all the tools you need to do this business. But then the time comes to fish or cut bait and you find yourself standing by the creek bank watching the water flow by. My friend, all the education in the world is worthless until you put it into practice.

The best time to start is now. And I mean right now. I want you to get up after you’ve finished reading this newsletter and do something that will get you going on your first deal. Call a Realtor for leads. Call a couple of sellers in the classifieds. Drive around looking for FSBO signs, or place your own “I Buy Houses” ad in the paper. Just Do It. You’ll be surprised how taking a tiny step will propel you forward towards your goals. You see, any one action on your part can produce a result. Of course the more actions you take, the more results you’ll get. Read More→

Using Your Self-Directed IRA to Invest in Hard-Money Lending – Part 1

Posted on September 6, 2013 byWhen a real estate developer runs into a snag, and needs additional money to complete a project, or he wants a shorter-term loan of, say, six months to six years, he frequently turns to the “hard-money” market. In a nutshell, these are lenders who are looking to get a decent return on their money, with a margin of safety. They usually do this by holding a lien on the property, or on another property the borrower owns, in a practice called “cross-collateralization.”

If you’ve got a lot of money in your self-directed IRA, and it’s been earning relatively weak returns, hard money lending provides a potentially lucrative way for you to “take charge” of your assets. With hard-money lending, you aren’t depending on the skills of a mutual fund manager you’ve never met, nor do you need to settle for the lackluster interest rates currently available from investment-grade bonds and treasuries.

Instead, you’re free to seek your own deals with any number of private real estate developers. Here are the advantages to hard-money lending in your self-directed IRA: Read More→

Case Study: Owner Carryback Financing

Posted on September 6, 2013 byWith the real estate markets slowing in many areas of the country, we are seeing a resurgence of owner carryback financing. Most of you are aware of the basics of such financing, but you may not have been exposed to some of the more creative approaches.

Let’s look at Jack who wants to move away from day-to-day management of his properties as he is involved in another business venture that is taking more of his time. He could just sell off his properties, pay the taxes and re-invest the proceeds in an investment that doesn’t require the management oversight.

One house Jack purchased some time ago for $100,000 is now worth $150,000. After concessions, realty fee and closing costs, Jack nets $140,000. And after the $80,000 mortgage is paid off, he has $60,000.

But hold on, federal and state taxes have to be paid. Between depreciation recapture and capital gains, taxes total about $12,000. So, Jack is left with $48,000 to invest. Read More→

Got Funding? Get Creative!

Posted on September 6, 2013 byFunding can be one of the largest barriers to entry in the real estate business. I remember the very first time I walked into a lenders office and tried to discuss funding for my first apartment complex I wanted to buy. My experience (or lack of) was immediately brought to my attention not to mention my complete lack of liquid assets (NO CASH!)

That day was quite sobering as I left that office although I was still determined to break into the real estate business. Which was a fortunate attitude seeing as I had quit my job as a pilot to go into real estate full time two weeks earlier.

What followed was the next 8 years of survival in the business and ultimately an almost 400 unit portfolio. I survived the Great Recession by mastering the techniques of creative financing such as seller financing, master lease options and raising private capital just to name a few.

If you are just starting out or whether you have been in the real estate business for a while, you always want to complete each transaction with as little cash out of your own pocket as necessary. The more cash you keep in your pocket the more options you keep open to yourself. Remember; Options = Cash! Read More→

Always Do A Little Thinking Before Making Every Offer

Posted on September 6, 2013 byIf I could wave a magic wand and re-live my early real estate investing career from the beginning, I think I would first try to learn more about what seller’s needs and thoughts are. I would also want to better understand the thoughts and logic that run through a seller’s mind when they are motivated and want to sell their house.

If I had a better idea of what the sellers wanted it will be much easier to make offers the seller might be happy with and hopefully get them to sell me their house at a price and terms I’ll be happy with, and they will get what they want and also be happy with. If I had only known what I know now it would have been far more profitable for me and my family.

I shudder to think of all of the lost deals I have had simply because I never stopped to think about what the seller’s needs were? My thoughts were usually about how I could make a killer deal for myself. This was not the best nor the most profitable way to make money buying real estate. You need to take a minute, step back and analyze what the seller’s wants or needs are, (or at the very least use a little logic to try to think about what the seller might want or need before making them an offer) if not, you are making a big mistake. If you think about what the sellers needs are you will have a distinct advantage while actually sitting face-to-face with them and are negotiating. If you will do this, at least you would have a direction to start going in.

As you talk with the seller and start to ask them the important questions you will start to better understand what is motivating them to sell. If you don’t ask the important questions you’ll never get the answers you need to put together a profitable deal – a deal which is good for both you and the seller. Let me explain… Read More→

Real Estate Investor Profits $68,000 Because of Her Mentor!

Posted on September 6, 2013 byDon’t Question Having a Mentor… JUST HAVE ONE!

I remember when I decided to quit my job as a legal secretary and become a millionaire in real estate! I started with Carleton Sheets’ course. Once it arrived, I was to read it and take action. Yeah, right! I found that between my J.O.B. (Just Over Broke) and taking care of my children, I was busy and distracted, so the course sat on my shelf collecting dust. About 6 months later, I got a call from Carleton Sheets’ organization asking if I wanted to be in their Mentor Program. How much? They said $2,000.00. At that time, I had to make a crucial decision that would change my life. Did I just want to “dream” about leaving my 9 to 5 job or did I really want to take action and make it happen? I thought about it for a couple of days and I said “YES!!” The training was just the start. I was able to purchase 6 homes following the course. Working in my home environment with so many interruptions was the hardest thing I have ever done in my life! I can tell you one thing, if it wasn’t for the Mentor pushing me… I would have given up and quit!

Just like many of you reading this article, I attended multiple boot camps and ordered over $250,000 worth of courses. The only difference between where I am in real estate and where you are, is that I took action and hired a Mentor to continue to push me forward and hold me accountable. And a Mentor gives you the answers to EVERY question you have! I am only quoting one of my students, “Having Kimberlee is like having personal access to your own magical Real Estate Encyclopedia! She has answers and solutions for everything!” That’s gotta give you some relief right there about what a Mentor can do for you! Everyone learns differently. Some people are visual learners and have to come to a class room and be taught, other people have to physically do a transaction to understand the process, and then some can pick up a book and do exactly as it says in the course and become successful. Read More→

Coach’s Response: What Are Your Four Answers?

Posted on September 6, 2013 byAs the market improves, I have more and more people coming to me for coaching. I am excited about this because it means that you are taking responsibility for your success. You are reading my articles, and you are talking with me to achieve what you want in your life.

One thing that I continually ask new investors to do is reflect on each deal, each interaction, each transaction. This allows you to see what was successful so that you can apply it again and thus achieve even more success.

Here is what I have found that will make our relationship even better (and thus your experience and profit even better): ANSWERS.

Before I can truly help you, there are…

Four Answers You Must Know

- How much Money is in it for YOU?

- What are you buying?

- What is the owner’s story?

- What is the area?

You MUST have these 4 questions answered

BEFORE I can help you make a deal.

Recently someone I was coaching came to me with what he thought was a great deal. Read More→

Too-Cool Tools: Embracing Tomorrow

Posted on September 6, 2013 by“The future starts today, not tomorrow.” ~ Pope John Paul II

Remember last month, when I talked about how amazing it is that one little smartphone or tablet can do so many useful things? Well, not everyone has much use for smartphones.

Take my Uncle Milt: He’s convinced that true happiness lies in a phone that’s just a phone. And he’s pretty sure iPads are, well, evil. Every time I see him, he grumbles about the latest new-fangled technology. Bad enough they invented the fax machine, he says – he never did get the hang of that thing. Too many buttons, and he never knew whether to dial 9 or 1 first. And don’t even mention that curly fax paper!

Well, yesterday Uncle Milt’s mentor told him he has to learn how to use an iPad. Uncle Milt is not a happy camper.

Does this sound like you? If it does, this month’s column is for you. Read More→

What Is Securitization and Why Is It Fraudulent? Part 1

Posted on September 6, 2013 byBy now you have heard in the news about robo-signing, MERS, etc. and how the economy was brought down by Mortgage Backed Securities. But what, specifically, does that mean and how does it affect us as homeowners and real estate investors? As can be expected, the greatest financial fraud every pulled over in the history of the world began with taking away responsibility from banks and brokers…

When a broker purchases a stock or bond with your money, it’s standard practice to buy the stock in the name of the brokerage. This was all well and good when the owners and partners of the brokerage were personally liable for all of the consequences of an investment. After brokerages were allowed to incorporate and become “legal persons,” the owners of the brokerage houses were shielded from all of the legal and financial responsibilities for the consequences of their investments. This took away all of the personal risk they incurred by making wild bets on exotic investments with their clients’ money. After all, it was just the company that would get in trouble, not the individual brokers or owners of the company!

This left the commercial and investment banks free to concoct the securitization scheme.

The way a bond is supposed to work is that an investor purchases a bond from a trust. The trust then was to use this money to purchase mortgages or originate their own. The trust then uses the money made off of these mortgages to pay off the bonds to their investors.

That’s how it is supposed to work. Read More→

Taking the Plunge to Go Full Time

Posted on September 6, 2013 byIf someone would have told me one year ago that I would be a full time real estate investor together with my husband and flipping houses for a living, I would have laughed at them! To be totally honest, real estate was never a passion of mine and I hadn’t given it much thought until I read “Rich Dad Poor Dad.” That got the wheels turning and when Matt (the hubby) discovered the niche of real estate we now love best…. Wholesaling… it seemed too good to be true! I was a total skeptic, but in the end, there were a few things that changed my mind and made me want to take the Plunge! In less than one year, we’ve flipped 44 properties totaling over $1,000,000. We’ve attended meetings almost nightly during the week, networked our rear ends off, attended classes, and met a lot of people. What we’ve discovered is that “taking the plunge” is often the hardest part for people even though they despise their jobs and know that real estate could be their vehicle out of the rat race.

So, what changed for me you might ask? How did I go from skeptic to believer and what does it REALLY take to make the plunge and ramp up a full time real estate career? It may not be for everyone, but for those who really want it… continue to read because I’m going to share my tips for “Making the Plunge!”

In the beginning, something that got me motivated to take charge was thinking about my financial future and looking at the statistics of the average American at retirement. We were barely making ends meet as it was, despite the fact that we were both working full time. The average American retires at 62 years of age and 95% of them are either dead broke or DEAD by that age! I couldn’t tolerate the thought of being a work horse for the remainder of my life only to pass on debt to my children and be a bother to them during the last years of my life. I didn’t know HOW this would all work out, but I was ready to look at some “other options!” Read More→

How to Find Motivated Sellers with Almost No Money

Posted on September 6, 2013 byYou can locate motivated sellers even if you have little or no money to work with. Way back in the early days of my business I used some very inexpensive techniques to locate very motivated sellers, since we only had a limited budget to work with like many people who are just starting out in the real estate business.

One technique we used was to develop a special flyer for ourselves. We then had it printed on legal paper in a bright color. Fluorescent paper works really well for this technique. The reason I used legal paper was because I could print two flyers to a page. That way I could get twice as many flyers for half the money. On a weekend, my husband and I would stick these flyers everywhere we could think of, in gas stations, phone booths, Laundromats, on public boards in grocery stores, home improvement stores, delis, bars, etc.

We would also take these flyers and lay them door to door during the weekend days at least twice a month. Each time we would lay the flyers door to door, we would pick a neighborhood we wanted to buy houses in. We kept a chart on the wall to show us which neighborhoods we had done and when. This was one way we could use to track the leads that began coming in. We ended up getting our exercise and doing something for our business at the same time, which was creating leads that turned into deals. Read More→

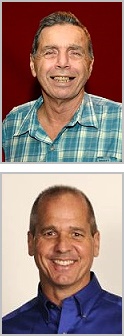

Tampa REIA Meeting on Sept 12 with Peter Fortunato & Bill Cook on Creative Deal Structuring

Posted on August 27, 2013 byWith Pete Fortunato and Bill Cook

Two Masters at Creative Deal Structuring and Financing

You meet with a seller. The seller is VERY motivated and DESPERATE to sell. You’ve been looking for a deal just like this one! Three Questions: How are you gonna fund it? How are you gonna structure it? And once you have it, what are you gonna do with it? Do you know how to use creative deal structuring and financing to make the IMPOSSIBLE deals POSSIBLE?

You meet with a seller. The seller is VERY motivated and DESPERATE to sell. You’ve been looking for a deal just like this one! Three Questions: How are you gonna fund it? How are you gonna structure it? And once you have it, what are you gonna do with it? Do you know how to use creative deal structuring and financing to make the IMPOSSIBLE deals POSSIBLE?

This meeting is like no other! There’s no hype and no bla-bla-bla! Come participate as two experienced investors, Peter Fortunato and Bill Cook, with nearly 70 years of combined real estate investing experience use real-world examples to show how you can make the impossible deals possible.

WARNING: This is NOT a sit-on-your-fanny-and-watch-the-show meeting. We want YOU to be part of the meeting and help us find the best ways a deal can be put together!

HERE’S HOW IT WORKS:

Pete and Bill will give you the following information about the seller and the seller’s property:

- A description of the property and its current fair-market value

- What needs to be rehabbed and the estimated cost of rehab

- Loans and liens against the property

- The seller’s situation (“Why they want to sell such a nice house like this.”)

- What the seller wants

Next, there will be a group discussion about how to best structure and fund the deal. Then Pete and Bill will reveal what they’d do and why they’d do it that way.

Wouldn’t you agree that this meeting is an INCREDIBLE opportunity to climb into the minds of two experienced real estate investors and see how their brains work as they construct win-win deals? How they not only make the impossible deals possible – but make them PROFITABLE?!!!

And it keeps getting better: Pete and Bill will also discuss how they fund their deals WITHOUT going to banks. Woe unto anyone who dares say that they can’t do a deal because they can’t get a bank loan. This is your only warning: If you say, “I can’t do the deal because I don’t have the money,” you’ll be on the receiving end of Bill’s deadly accurate marshmallow gun!!!

HERE ARE SOME OF THE STRUCTURING TECHNIQUES PETE AND BILL WILL TOUCH ON:

- Owner-carryback Financing

- Using Private Money Lenders

- Subject-to Deals

- Deed for Note Deals

- Lonnie Deals

- Master Leases

- Options

BONUS #1: Pete will show you his Benefit’s House. Most investors think a deal consists of just one thing: the house. Actually, a deal has eight parts: Growth, Income, Amortization, Profits, Management, Tax Benefits and Use. You want to be there when Pete talks about how he uses the different parts to make a deal work!

BONUS #2: Bill has knocked on homeowners’ doors for a living for more than 35 years. He’ll show you exactly what he does at a seller’s door to get 8 out of 10 sellers to invite him in to see their home.

Come early! Come ready to learn! Come with pad and pen! Come ready to participate! Come join us at Tampa REIA on Thursday, September 12th at 6:00 PM at the Doubletree Suites Tampa Bay located at 3050 North Rocky Point Dr West in Tampa, FL!

This real estate investors meeting will be like no other meeting you’ve ever attended. Your mind will NEVER be able to SHRINK back to its before-the-meeting size! After this meeting, you’re gonna need a new and bigger hat! And after this meeting, you’re gonna KNOW WHAT’S POSSIBLE!!!

WIN A CRUISE: All participants who attend the Tampa REIA Meeting will entered into a drawing for a chance to win a *Complimentary 2 Day Cruise to the Bahamas with Caribbean Cruise Line! *You must be present at the meeting to win. The 2 day Cruise does not include port fees, transportation and taxes.

WIN A CRUISE: All participants who attend the Tampa REIA Meeting will entered into a drawing for a chance to win a *Complimentary 2 Day Cruise to the Bahamas with Caribbean Cruise Line! *You must be present at the meeting to win. The 2 day Cruise does not include port fees, transportation and taxes.

After the conclusion of the Tampa REIA Main Meeting (around 9:30PM), we will be reconvening at Whiskey Joe’s Bar & Grill located at 7720 West Courtney Campbell Causeway in Tampa for the “Meeting after the Meeting”. Come eat, drink, network and have fun with us as hang out late into the night on Tampa Bay!

After the conclusion of the Tampa REIA Main Meeting (around 9:30PM), we will be reconvening at Whiskey Joe’s Bar & Grill located at 7720 West Courtney Campbell Causeway in Tampa for the “Meeting after the Meeting”. Come eat, drink, network and have fun with us as hang out late into the night on Tampa Bay!

Let’s Go Meet Face-to-Face With Sellers on Thursday, Sept 12th

Posted on August 27, 2013 byWith Bill Cook

Do you want to SEE the fastest, cheapest, most effective way to get face-to-face with motivated sellers?

Then join me, Bill Cook, for a day full of door knocking with real sellers on Thursday, September 12th from 8:30 AM – 3:00 PM. We’ll spend the day out talking to sellers and constructing win-win deals at their kitchen tables.

Then join me, Bill Cook, for a day full of door knocking with real sellers on Thursday, September 12th from 8:30 AM – 3:00 PM. We’ll spend the day out talking to sellers and constructing win-win deals at their kitchen tables.

What’s the fastest, cheapest, most effective way to get face-to-face with motivated sellers? When you see a For Sale sign in a seller’s yard, get out of your car and knock on the seller’s door. It’s as simple as that!

I know what you’re thinking: The seller will slam the door in my face; the seller will yell at me; the seller will tell me to get lost.

I know something else, too: You say this having never spent a single day out knocking on homeowners’ doors – especially out knocking doors with someone who has done it for more than 35 years!

Some of the Questions I’ll Answer While We’re Out Door Knocking:

- Which homes should you go to?

- How and where should you stand when at the seller’s door?

- What should you carry with you?

- What do you say when the seller answers the door?

- What do you do if no one is home?

- Why will 8 out of 10 sellers invite you in?

- What are the best types of neighborhoods to work?

- What do you do after the seller invites you in?

- How do you get to the seller’s kitchen table and why it’s THE place to be?

- What are the MOST important questions to ask a seller?

- How do you construct a win-win offer?

- What do you do if the house is vacant or bank owned?

On Thursday, September 12, 2013 at 8:30 AM, I’ll be taking a select group of real estate investors out door knocking on the day of the Tampa REIA meeting. We’ll be meeting in the Home Depot parking lot located at 6730 Memorial Hwy, Tampa, FL (Town & Country) at 8:30 AM SHARP. That night, Peter Fortunato and I will be showing you how to creatively structure and fund win-win deals at the monthly Tampa REIA meeting.

On Thursday, September 12, 2013 at 8:30 AM, I’ll be taking a select group of real estate investors out door knocking on the day of the Tampa REIA meeting. We’ll be meeting in the Home Depot parking lot located at 6730 Memorial Hwy, Tampa, FL (Town & Country) at 8:30 AM SHARP. That night, Peter Fortunato and I will be showing you how to creatively structure and fund win-win deals at the monthly Tampa REIA meeting.

Just think, you have the opportunity to spend the day out meeting with sellers in the real world with someone who has made his living knocking on homeowners’ doors for more than 35 years!

I promise you’ll come away with some really great stories, plus a couple of big Ah-Hah moments that can dramatically change the course of your real estate investing life!

101 Plus Ways to Generate Motivated Buyer & Seller Leads Online Workshop

Posted on August 27, 2013 byMotivated Buyer & Seller Leads

Online Workshop

A 4 Part Online Workshop with Dustin Griffin

Starting on September 6th

Join us online starting on Friday, September 6th for our Online Workshop where you will learn “101+ Ways to Generate Buyer & Seller Leads” for your real estate investing business. For your convenience, this class is being offered online in 4 parts starting on Sept 6th with the other 3 parts taking place on Sept 13, 20 and 27*. You will be able to watch each of these sessions on your schedule, over and over again as needed by logging into on TampaREIA.com’s Member Only Area. If you are not an Tampa REIA Member, you can Join Tampa REIA first and attend this Online Workshop at No Charge for a limited time only.

Dustin Griffin is going to teach you many of the 800 Pound Guerilla Marketing Strategies and Techniques he and other successful investors use to generate all the buyer and seller leads they can handle on a low budget and how you can too.

Dustin Griffin is going to teach you many of the 800 Pound Guerilla Marketing Strategies and Techniques he and other successful investors use to generate all the buyer and seller leads they can handle on a low budget and how you can too.

He is going to teach you how you can totally dominate your local competition with little effort and a relatively low budget using new and traditional marketing techniques, a little creativity and the power of the Internet.

*PLEASE NOTE: Non-Members who Join Tampa REIA for the first time between August 29th and September 12th may attend for FREE! Just be sure to let us know that you want to attend this event at no charge after you join.

Schedule & Agenda*

*The following dates and agenda are subject to change at instructor’s sole discretion.

Sept 6, 2013: Session #1 – Introduction to Marketing

Sept 13, 2013: Session #2 – 101+ Ways to Generate Leads

Sept 20, 2013: Session #3 – 101+ Ways to Generate Leads (Continued)

Sept 27, 2013: Bonus Session #4 – Even More Ways to Generate Leads