Archive for August, 2013

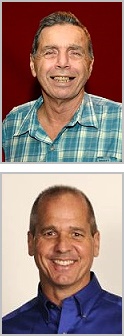

Tampa REIA Meeting on Sept 12 with Peter Fortunato & Bill Cook on Creative Deal Structuring

Posted on August 27, 2013 byWith Pete Fortunato and Bill Cook

Two Masters at Creative Deal Structuring and Financing

You meet with a seller. The seller is VERY motivated and DESPERATE to sell. You’ve been looking for a deal just like this one! Three Questions: How are you gonna fund it? How are you gonna structure it? And once you have it, what are you gonna do with it? Do you know how to use creative deal structuring and financing to make the IMPOSSIBLE deals POSSIBLE?

You meet with a seller. The seller is VERY motivated and DESPERATE to sell. You’ve been looking for a deal just like this one! Three Questions: How are you gonna fund it? How are you gonna structure it? And once you have it, what are you gonna do with it? Do you know how to use creative deal structuring and financing to make the IMPOSSIBLE deals POSSIBLE?

This meeting is like no other! There’s no hype and no bla-bla-bla! Come participate as two experienced investors, Peter Fortunato and Bill Cook, with nearly 70 years of combined real estate investing experience use real-world examples to show how you can make the impossible deals possible.

WARNING: This is NOT a sit-on-your-fanny-and-watch-the-show meeting. We want YOU to be part of the meeting and help us find the best ways a deal can be put together!

HERE’S HOW IT WORKS:

Pete and Bill will give you the following information about the seller and the seller’s property:

- A description of the property and its current fair-market value

- What needs to be rehabbed and the estimated cost of rehab

- Loans and liens against the property

- The seller’s situation (“Why they want to sell such a nice house like this.”)

- What the seller wants

Next, there will be a group discussion about how to best structure and fund the deal. Then Pete and Bill will reveal what they’d do and why they’d do it that way.

Wouldn’t you agree that this meeting is an INCREDIBLE opportunity to climb into the minds of two experienced real estate investors and see how their brains work as they construct win-win deals? How they not only make the impossible deals possible – but make them PROFITABLE?!!!

And it keeps getting better: Pete and Bill will also discuss how they fund their deals WITHOUT going to banks. Woe unto anyone who dares say that they can’t do a deal because they can’t get a bank loan. This is your only warning: If you say, “I can’t do the deal because I don’t have the money,” you’ll be on the receiving end of Bill’s deadly accurate marshmallow gun!!!

HERE ARE SOME OF THE STRUCTURING TECHNIQUES PETE AND BILL WILL TOUCH ON:

- Owner-carryback Financing

- Using Private Money Lenders

- Subject-to Deals

- Deed for Note Deals

- Lonnie Deals

- Master Leases

- Options

BONUS #1: Pete will show you his Benefit’s House. Most investors think a deal consists of just one thing: the house. Actually, a deal has eight parts: Growth, Income, Amortization, Profits, Management, Tax Benefits and Use. You want to be there when Pete talks about how he uses the different parts to make a deal work!

BONUS #2: Bill has knocked on homeowners’ doors for a living for more than 35 years. He’ll show you exactly what he does at a seller’s door to get 8 out of 10 sellers to invite him in to see their home.

Come early! Come ready to learn! Come with pad and pen! Come ready to participate! Come join us at Tampa REIA on Thursday, September 12th at 6:00 PM at the Doubletree Suites Tampa Bay located at 3050 North Rocky Point Dr West in Tampa, FL!

This real estate investors meeting will be like no other meeting you’ve ever attended. Your mind will NEVER be able to SHRINK back to its before-the-meeting size! After this meeting, you’re gonna need a new and bigger hat! And after this meeting, you’re gonna KNOW WHAT’S POSSIBLE!!!

WIN A CRUISE: All participants who attend the Tampa REIA Meeting will entered into a drawing for a chance to win a *Complimentary 2 Day Cruise to the Bahamas with Caribbean Cruise Line! *You must be present at the meeting to win. The 2 day Cruise does not include port fees, transportation and taxes.

WIN A CRUISE: All participants who attend the Tampa REIA Meeting will entered into a drawing for a chance to win a *Complimentary 2 Day Cruise to the Bahamas with Caribbean Cruise Line! *You must be present at the meeting to win. The 2 day Cruise does not include port fees, transportation and taxes.

After the conclusion of the Tampa REIA Main Meeting (around 9:30PM), we will be reconvening at Whiskey Joe’s Bar & Grill located at 7720 West Courtney Campbell Causeway in Tampa for the “Meeting after the Meeting”. Come eat, drink, network and have fun with us as hang out late into the night on Tampa Bay!

After the conclusion of the Tampa REIA Main Meeting (around 9:30PM), we will be reconvening at Whiskey Joe’s Bar & Grill located at 7720 West Courtney Campbell Causeway in Tampa for the “Meeting after the Meeting”. Come eat, drink, network and have fun with us as hang out late into the night on Tampa Bay!

Let’s Go Meet Face-to-Face With Sellers on Thursday, Sept 12th

Posted on August 27, 2013 byWith Bill Cook

Do you want to SEE the fastest, cheapest, most effective way to get face-to-face with motivated sellers?

Then join me, Bill Cook, for a day full of door knocking with real sellers on Thursday, September 12th from 8:30 AM – 3:00 PM. We’ll spend the day out talking to sellers and constructing win-win deals at their kitchen tables.

Then join me, Bill Cook, for a day full of door knocking with real sellers on Thursday, September 12th from 8:30 AM – 3:00 PM. We’ll spend the day out talking to sellers and constructing win-win deals at their kitchen tables.

What’s the fastest, cheapest, most effective way to get face-to-face with motivated sellers? When you see a For Sale sign in a seller’s yard, get out of your car and knock on the seller’s door. It’s as simple as that!

I know what you’re thinking: The seller will slam the door in my face; the seller will yell at me; the seller will tell me to get lost.

I know something else, too: You say this having never spent a single day out knocking on homeowners’ doors – especially out knocking doors with someone who has done it for more than 35 years!

Some of the Questions I’ll Answer While We’re Out Door Knocking:

- Which homes should you go to?

- How and where should you stand when at the seller’s door?

- What should you carry with you?

- What do you say when the seller answers the door?

- What do you do if no one is home?

- Why will 8 out of 10 sellers invite you in?

- What are the best types of neighborhoods to work?

- What do you do after the seller invites you in?

- How do you get to the seller’s kitchen table and why it’s THE place to be?

- What are the MOST important questions to ask a seller?

- How do you construct a win-win offer?

- What do you do if the house is vacant or bank owned?

On Thursday, September 12, 2013 at 8:30 AM, I’ll be taking a select group of real estate investors out door knocking on the day of the Tampa REIA meeting. We’ll be meeting in the Home Depot parking lot located at 6730 Memorial Hwy, Tampa, FL (Town & Country) at 8:30 AM SHARP. That night, Peter Fortunato and I will be showing you how to creatively structure and fund win-win deals at the monthly Tampa REIA meeting.

On Thursday, September 12, 2013 at 8:30 AM, I’ll be taking a select group of real estate investors out door knocking on the day of the Tampa REIA meeting. We’ll be meeting in the Home Depot parking lot located at 6730 Memorial Hwy, Tampa, FL (Town & Country) at 8:30 AM SHARP. That night, Peter Fortunato and I will be showing you how to creatively structure and fund win-win deals at the monthly Tampa REIA meeting.

Just think, you have the opportunity to spend the day out meeting with sellers in the real world with someone who has made his living knocking on homeowners’ doors for more than 35 years!

I promise you’ll come away with some really great stories, plus a couple of big Ah-Hah moments that can dramatically change the course of your real estate investing life!

101 Plus Ways to Generate Motivated Buyer & Seller Leads Online Workshop

Posted on August 27, 2013 byMotivated Buyer & Seller Leads

Online Workshop

A 4 Part Online Workshop with Dustin Griffin

Starting on September 6th

Join us online starting on Friday, September 6th for our Online Workshop where you will learn “101+ Ways to Generate Buyer & Seller Leads” for your real estate investing business. For your convenience, this class is being offered online in 4 parts starting on Sept 6th with the other 3 parts taking place on Sept 13, 20 and 27*. You will be able to watch each of these sessions on your schedule, over and over again as needed by logging into on TampaREIA.com’s Member Only Area. If you are not an Tampa REIA Member, you can Join Tampa REIA first and attend this Online Workshop at No Charge for a limited time only.

Dustin Griffin is going to teach you many of the 800 Pound Guerilla Marketing Strategies and Techniques he and other successful investors use to generate all the buyer and seller leads they can handle on a low budget and how you can too.

Dustin Griffin is going to teach you many of the 800 Pound Guerilla Marketing Strategies and Techniques he and other successful investors use to generate all the buyer and seller leads they can handle on a low budget and how you can too.

He is going to teach you how you can totally dominate your local competition with little effort and a relatively low budget using new and traditional marketing techniques, a little creativity and the power of the Internet.

*PLEASE NOTE: Non-Members who Join Tampa REIA for the first time between August 29th and September 12th may attend for FREE! Just be sure to let us know that you want to attend this event at no charge after you join.

Schedule & Agenda*

*The following dates and agenda are subject to change at instructor’s sole discretion.

Sept 6, 2013: Session #1 – Introduction to Marketing

Sept 13, 2013: Session #2 – 101+ Ways to Generate Leads

Sept 20, 2013: Session #3 – 101+ Ways to Generate Leads (Continued)

Sept 27, 2013: Bonus Session #4 – Even More Ways to Generate Leads

Read More→

Online Lead Finder Software Version 2.5.3 – FREE for Tampa REIA Members

Posted on August 15, 2013 by Duncan has updated his famous Online Lead Finder Software once again! Now, as of today, August 15th, Duncan has done it once again with version 2.5.3! Duncan also wanted us to advise you on some upcoming changes to the Online Lead Finder Software as he continues to add more and more features. In the next, 30 – 45 days, Duncan will be raising the price of the software from $497 to $697. By the end of the year he will raise the price to $997 as he continues to add even more powerful and profitable features. He will also soon be charging an annual maintenance fee for ongoing upgrades upon the completion of Version 3.0.

Duncan has updated his famous Online Lead Finder Software once again! Now, as of today, August 15th, Duncan has done it once again with version 2.5.3! Duncan also wanted us to advise you on some upcoming changes to the Online Lead Finder Software as he continues to add more and more features. In the next, 30 – 45 days, Duncan will be raising the price of the software from $497 to $697. By the end of the year he will raise the price to $997 as he continues to add even more powerful and profitable features. He will also soon be charging an annual maintenance fee for ongoing upgrades upon the completion of Version 3.0.

Despite these forthcoming price and policy changes, there is some very good news. If you are currently and Tampa REIA Gold Member or Become a Gold Member before the upcoming deadline which will be September 1st, you will be grandfathered into the program and continue to receive the unlimited version of the software and all upgrades for FREE as long as you remain an active Tampa REIA Gold Member.

Even if you miss the deadline and become an Tampa REIA Gold Member in the future, you will be able to purchase the unlimited edition of the software for $100 and get a 50% discount on the annual maintenance and upgrade fee. But to be grandfathered in for FREE indefinitely, join Tampa REIA as a Gold Member and maintain your membership each year.

If you are an Tampa REIA Silver Member, the Silver Edition, which is limited to 25 leads per day, will continue to be FREE as will all future upgrades.

If you are an Tampa REIA Member you can download the latest version of software for FREE by Read More→

101 Plus Ways to Generate Motivated Buyer & Seller Leads Workshop in Orlando on August 17, 2013

Posted on August 15, 2013 byMotivated Buyer & Seller Leads

A Full Day Workshop with Dustin Griffin on August 17th

From 8:30AM – 5PM in Orlando, FL

Join us in Tampa on Saturday, August 17th at 8:30 AM at the Comfort Inn & Suites located at 626 Lee Road in Orlando, FL to learn “101 Plus Ways to Generate Buyer & Seller Leads” for your real estate investing business.

Join us in Tampa on Saturday, August 17th at 8:30 AM at the Comfort Inn & Suites located at 626 Lee Road in Orlando, FL to learn “101 Plus Ways to Generate Buyer & Seller Leads” for your real estate investing business.

Dustin Griffin is going to teach you many of the 800 Pound Guerilla Marketing Strategies and Techniques he and other successful investors use to generate all the buyer and seller leads they can handle on a low budget and how you can too.

He is going to teach you how you can totally dominate your local competition with little effort and a relatively low budget using new and traditional marketing techniques, a little creativity and the power of the Internet.

Be sure to bring a pen and paper to take lots of notes as well as at least 5 to 10 examples of what you are currently doing to market your business to share with the class. The more examples we have to share, the better!

|

Upcoming Workshop Dates |

|

Read More→

Dustin Griffin is Teaching Guerilla Marketing at the Investors Resource Center in Orlando on August 15, 2013

Posted on August 15, 2013 byStrategies You Can Use to Generate

All the Leads You Can Handle

Dustin Griffin will be speaking at the Investors Resource Center (IRC) on Thursday, August 15th at 7:30PM at the Winter Park Civic Centerlocated at 1050 W. Morse Blvd in Winter Park, Fl on many of the “800 Pound Guerilla Marketing Strategies and Techniques” he and other successful investors use to generate motivated buyer and seller leads. Dustin is the Executive Director of the Tampa REIA, Atlanta REIA and Charlotte REIA and is also an entrepreneur, real estate investor, website developer, internet marketing enthusiast and a husband and proud father of two.

Dustin Griffin will be speaking at the Investors Resource Center (IRC) on Thursday, August 15th at 7:30PM at the Winter Park Civic Centerlocated at 1050 W. Morse Blvd in Winter Park, Fl on many of the “800 Pound Guerilla Marketing Strategies and Techniques” he and other successful investors use to generate motivated buyer and seller leads. Dustin is the Executive Director of the Tampa REIA, Atlanta REIA and Charlotte REIA and is also an entrepreneur, real estate investor, website developer, internet marketing enthusiast and a husband and proud father of two.

Are you generating enough motivated buyer and seller leads each month to survive and thrive in today’s competitive real estate market? Are you generating at least 30-50 leads per month from your current marketing efforts? If not generating this many leads or more, you should join us for our next IRC Meeting to learn how to generate all the leads you need to run a successful homebuying business.

Come join us and learn how you too can totally dominate your local competition with little effort and a relatively low budget using new and traditional marketing techniques, a little creativity and the power of the Internet. And if you want even more marketing training, Dustin will be back on Saturday, August 17th for a full day workshop on “101 Plus Ways to Generate Motivated Buyer & Seller Leads”.

WIN A CRUISE: All participants who attend the IRC Meeting on August 15th and Workshop on August 17th will entered into a drawing for a chance to win a *Complimentary 2 Day Cruise to the Bahamas with Caribbean Cruise Line! *You must be present at the meeting and workshop to win. The 2 day Cruise does not include port fees, transportation and taxes.

WIN A CRUISE: All participants who attend the IRC Meeting on August 15th and Workshop on August 17th will entered into a drawing for a chance to win a *Complimentary 2 Day Cruise to the Bahamas with Caribbean Cruise Line! *You must be present at the meeting and workshop to win. The 2 day Cruise does not include port fees, transportation and taxes.

The Profit August 2013 Edition

Posted on August 6, 2013 by The August 2013 edition of The Profit Newsletter has arrived just in time for our Tampa REIA Meeting on August 8th. You can download The Profit Newsletter as a High Quality PDF (Recommended) or Low Res PDF (for slower devices). The Profit Newsletter is the official newsletter of the Tampa Real Estate Investors Alliance and is a digital, interactive newsletter for new and seasoned real estate investors delivered as an Adobe PDF file to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices with a PDF reader. Many of the articles and ads in The Profit contain hyperlinks you can click or tap to visit websites, watch videos, listen to audios, download content, send emails, comment on articles, share socially and much more! The high res version of The Profit is “print ready” for those who want to print the newsletter on their home or business printer. Also, be sure to Subscribe to The Profit so you don’t miss a single monthly issue.

The August 2013 edition of The Profit Newsletter has arrived just in time for our Tampa REIA Meeting on August 8th. You can download The Profit Newsletter as a High Quality PDF (Recommended) or Low Res PDF (for slower devices). The Profit Newsletter is the official newsletter of the Tampa Real Estate Investors Alliance and is a digital, interactive newsletter for new and seasoned real estate investors delivered as an Adobe PDF file to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices with a PDF reader. Many of the articles and ads in The Profit contain hyperlinks you can click or tap to visit websites, watch videos, listen to audios, download content, send emails, comment on articles, share socially and much more! The high res version of The Profit is “print ready” for those who want to print the newsletter on their home or business printer. Also, be sure to Subscribe to The Profit so you don’t miss a single monthly issue.

Marketing to Owners of Vacant Houses

Posted on August 6, 2013 by Last month’s article was on “Driving for Dollars and Farming with Flyers”. As you are out driving neighborhoods in search of houses to buy, you will soon discover that there are many vacant houses out there. Some of these houses are obviously for sale or rent as indicated by a sign in the yard, but many are not so obvious. These houses are just sitting empty, often deteriorating, waiting for someone like you to come along and buy them. Many of these houses appear to have been abandoned and unkept.

Last month’s article was on “Driving for Dollars and Farming with Flyers”. As you are out driving neighborhoods in search of houses to buy, you will soon discover that there are many vacant houses out there. Some of these houses are obviously for sale or rent as indicated by a sign in the yard, but many are not so obvious. These houses are just sitting empty, often deteriorating, waiting for someone like you to come along and buy them. Many of these houses appear to have been abandoned and unkept.

Vacant houses often provide some of the best opportunities to create some killer deals. After all, many of the houses have mortgages, taxes and other expenses that the owner is responsible for paying, even as the house sites vacant and unused. Even houses that are free and clear have expenses the owner must pay to avoid tax liens and code enforcement violations. Since the owner doesn’t live in the house, they are often highly motivated and more than willing to do just about anything to get rid of it.

When I am out driving neighborhoods and spot a vacant house, I stop and take pictures and write down the address. If the house is for sale by owner or for rent, I write down the number on the sign and call the owner later. I will even call Realtors from time to time if I know the house has been sitting vacant for a while since the owner might be motivated and eager to sell. Read More→

If You Want to Be a Successful Investor Always Do Everything On Purpose

Posted on August 6, 2013 byHello fellow investors,

I hope you enjoyed the 4th of July last month and took a moment to think about the fact that this country has fought many wars to give each one of us independence and the ability to create and do business as we wish with unlimited income potential. In this country our income is only limited to our vision and our determination to succeed at what we choose.

As the year goes on I am getting reports that many of my students are doing deals and starting to make some serious money, and I’m not talking about doing short sales or wholesale deals exclusively. One of my students found a seller who has 80 free and clear houses they want to sell and are willing to do seller financing terms. My student is cherry-picking the deals she wants and is finally deciding that sending letters is a good thing not a laborious waste of time. Three of my other students who are working together have bought 40 properties since the first of the year all with seller financing terms and many with zero percent interest rates and monthly payments as little as $200. I had lunch with another student from Missouri yesterday who has four properties ready to close in less than a month and one of the properties doesn’t have a monthly payment due for 12 full months and zero interest. All of these deals my students are doing are coming from their letter campaign sending letters to “Non-Owner Occupied – FREE & CLEAR” Property Owners. Read More→

Getting Back Up – Making Failure into Success

Posted on August 6, 2013 byIt is as easy to succeed as it is to fail. Why does this sound untrue? Because most of us forget that we have a choice: we can enjoy the good and overcome the negative. What we must remember is that when we encounter something that we initially see as negative, we have a choice about how to react.

Did you know that Harland David Sanders, the famous KFC “Colonel”, couldn’t sell his chicken? More than 1,000 restaurants rejected him.

Or that Walt Disney was fired by a newspaper editor because he “lacked imagination and had no good ideas”?

Or that Henry Ford’s first auto company went out of business?

What made these people successful after so many “failures”? Read More→

Is Buying a Note a Good Deal?

Posted on August 6, 2013 byWhich is better for real estate investors – buying a note in pre-foreclosure, buying the house through a short sale, or waiting until the house comes on the market as an REO? That depends on the difference in the discounts expected, the condition of the house, and the likelihood of reaching an agreement with the current homeowner to either move or purchase the note at a discount and remain in the house.

The discount on the note may well be less than the amount of discount the lender will be willing to take for the house as an REO. Having the note gives the note holder considerable flexibility—and some additional risks. The note buyer can decide to set up a new mortgage with the current homeowner, negotiate a “cash for keys” or deed-in-lieu of foreclosure with the homeowner, or may be stuck taking the homeowner through a long, drawn-out foreclosure process. If the latter happens, then the note buyer may well be better off waiting until the home comes on the REO market rather than tying up funds unproductively waiting for the foreclosure process to complete. However, if you have a cooperative homeowner, buying the note presents you with some incredible opportunities. Read More→

Landlords: How to Increase Cash Flow WITHOUT Raising Rents

Posted on August 6, 2013 byOne of the biggest mistakes we continually see real estate investors make is buying a rental property that produces a NEGATIVE monthly cash flow. When it comes to rental properties, positive cash flow is much more important than equity!

Here’s a typical example: An investor buys a single-family rental for $90,000. The property will rent for $725 per month and have mortgage payments of $485. The investor thinks: Wow, the property will produce a positive monthly cash flow of $240 – boy will I be sitting pretty.

But what about little expenses such as property taxes, insurance, repairs, vacancies, and management? When you factor these costs into the equation you suddenly find yourself knee deep in a pit of money-losing quicksand.

Always remember that investors make their profit – including positive cash flow – when BUYING the property. For a deal to be profitable, it’s critical that you know all the numbers and structure it accordingly. Read More→

Does the Real Estate Market Follow Economic Trends?

Posted on August 6, 2013 byOkay, the media in general is touting the US economy is doing better than it has over the last bunch of quarters. People across the country are working again. Typically this news leads people to feel better about the overall economy. More directly, this has translated to a recovery in the real estate market.

Signs show home values are coming up from the lows of 2008-2011. It is easy to keep track of values using REIAComps. Sales in many markets have been increasing and there a good volume of houses to choose from and lastly the number of folks looking to buy are up.

These previously mentioned factors are good for people who purchased at the height in 2004-2007. This was the time period when negative equity was born. Upside down mortgages became common place far too often. Read More→

7 Deadly Mistakes You Can Avoid – Part 2

Posted on August 6, 2013 by(This article is continued from Part 1 in the July 2013 Edition of The Profit Newsletter.)

-

Listening to poor advice. This is something you probably already know. As you go through life, there will never be a shortage of people who want to give you advice. Your parents, your spouse, friends, in-laws, kids, they all have opinions about what you’re doing and what they think you should be doing. Very often, the value of their advice is worth exactly what you paid for it . . . nothing!

I’m not saying these do-gooders aren’t honest, intelligent and well-intentioned. However, you must ask yourself, are these folks qualified to give you advice? Have they had any experience in what you’re doing? It seems to be human nature for people to offer advice on subjects they know nothing about. What baffles me is how often the recipients of this so-called wisdom will listen to it and even act upon it without ever questioning the credentials of those giving it.

Through many painful experiences, I’ve learned that when you take advice from people who don’t know any more about the subject matter than you do, the quality of that advice is, at best, suspect. Plus, very often, listening to unqualified advice can have a negative impact on your focus (see roadblock #1).

So, who should you be listening to? I believe in taking advice only from people who are: Read More→

Rehabbing with Creative Financing

Posted on August 6, 2013 byIf you have looked at more than a few deals over the last year you have undoubtedly seen a distressed asset. Repairs needed, low occupancy, bad management (or tenants) are some examples, just to name a few. From single family to large apartment complexes there are distressed assets in all types of real estate these days. Fortunately they can be hidden goldmines if you know how to get financing. Most lenders are not lending on distressed assets, making it harder to close these deals, let alone mitigate the needed repairs.

My favorite way to deal with this is with a master lease option or seller financing. If you can get the seller to give you control of the property then you can do the fix-up and flip it for cash or keep it for cash flow!

Either way you structure the deal, the idea is to limit the cost of getting into the deal because you will have repairs and other expenses to overcome while you get the property cash flowing. Here are some tips for getting started with a rehab property using creative financing. Read More→

CASH or CASH FLOW???

Posted on August 6, 2013 byHope everyone is doing well and out there putting out their marketing, getting leads, and doing deals. You can’t make much money in real estate if you aren’t doing deals, right? Real estate “Deals” can come in many forms. You can have a wholesale flip, where you are basically flipping the contract for a fee or doing a double closing. You might be closing on a house yourself that you intend to fix up and resell (fix n flip). When you resell that house, which would be considered a deal, and that is when you get paid (my favorite part). You might have just bought a house from the bank or a wholesaler that you intend to put a renter in. You may have just stroked a deal with a home owner to “owner finance” their house and you intend to rent it out. Or, you were able to negotiate a lease option with a home owner with a nice low down payment and monthly payment, and you can turn around and lease option that to somebody else for a higher down payment and higher monthly payment – very nice!

Gotta love Real Estate – so many ways to make money!! But we’re not in it for the money are we? Yeah – we are. Ha! Read More→

How to Get a FREE Phone Number to Use in Your Business – Part 1

Posted on August 6, 2013 byToday, I’m going to combine marketing & technology to share an extremely powerful tool that you can use for a TON of different uses in your home or office – all for absolutely FREE!

As anyone in marketing knows, the PHONE is one of the strongest weapons you need to use. Making calls, taking calls, and sending or receiving text messages or even broadcasting voice blasts are all things we need to do to reach and serve our customers.

If you’re buying houses, you need a phone number to use in your marketing to get your motivated seller prospects to contact you. If you’re selling houses, you should have a separate phone number for that. If you’re offering any other type of services, such as consulting, etc., guess what? You should use another number for that!

The trouble is, getting all these phone numbers & systems can add up to be substantial sum, and can add to your overhead expenses very quickly.

So what can you do? Well, the major phone companies don’t want you to know about your options, because they want your money – as much of it as they can squeeze out of you! That’s why companies like Vonage & MagicJack have gained so much popularity recently – because they essentially give you the same services for a much cheaper price. Read More→

The Art Of The Conversation With Motivated Sellers – Part 2

Posted on August 6, 2013 bySo how are we going to get ready to have a conversation with our motivated sellers? I believe that readiness is a state of mind, and I have put together some ideas for you designed to help you have meaningful and successful conversations with motivated sellers resulting in profitable deals.

First of all, expect to be anxious and know that it’s okay to be anxious. You probably wouldn’t be very good at what you do if you didn’t care about the outcome.

Next, while you are feeling anxious, get in front of a mirror and practice what you are going to say to the seller. Do this more than once. The more you practice what you are going to say, the more comfortable you will be and therefore less likely to forget what you were going to say. Practice controlling your voice and be mindful of how fast you are talking. Your speech should be at a moderate volume and speed when speaking to a seller.

Remember to breathe! Practice what you are going to say all the way through without making faces, gasping or throwing out any expletives. Your seller doesn’t care if you’re speech is perfect, they just want to know what you can do for them to help them solve their problem. You might even want to practice what you are going to say in front of a spouse or close friend. Read More→

Self-Directed IRA and Real Estate – A Popular Combination

Posted on August 6, 2013 byCombining a self-directed IRA and real estate is a trend that is picking up speed fast! Real estate investors are redirecting their focus and purchasing homes with their self-directed IRAs in mass. Partly because they refuse to settle for living on the measly average $1,230 per month social security check that many retirees are forced to budget with.

Large companies are cutting back on their employees’ hours in preparation for the Obama Care regulations and this change is causing people to rethink their futures prompting them to obtain both a self-directed IRA and real estate investments. With their salaries shrinking, they are looking for alternative revenue streams to build their retirement accounts.

So why is real estate picking up steam? Many people have lost their homes to foreclosure, others can’t get financing due to the new bank regulations, and some people simply do not have enough confidence in the real estate market to buy a home so they are looking for rental properties to live in. For these reasons, the demand for rental properties is at an all-time high and real estate prices, while slightly on the rise, are still low enough to make this an investors’ market. Large cities listed in the top 10 fastest-growing U.S. cities of 2013 are among the most sought after in the rental market. There are droves of residential properties on the market at great prices and investors are buying them up quickly. Read More→

Using Trusts to Own Real Estate – Part 2

Posted on August 6, 2013 byOTHER TRUSTS

There are numerous possibilities for the name given to a trust. Such names are often chosen to reflect the primary function of the trust: Education Trust; Wealth Replacement Trust; Charitable Remainder Trust; Spendthrift Dynasty Trust, etc.

Since names are assigned to trusts the public can get the wrong impression. It is often assumed that a named trust is like any other consumer good, such as the name ‘car’ or ‘truck’. A person wants to buy, say, a car but not a truck. They want a Spendthrift, but not an Education Trust. Actually all trusts are just trusts. The primary thing that differentiates them are clauses written into the trusts. For example, a single clause will turn an education trust into a spendthrift education trust.

The point is not to let names become confusing. The fundamentals of trusts are simple to comprehend. First, all trusts are either inter vivos or Testamentary. Inter vivos trusts are set up while the grantor is alive and are often referred to as a ‘living trust’. The testamentary trust, on the other hand, is set up after the person’s death by authority written in the deceased’s will. All trusts will be either an inter vivos or a testamentary trust. Read More→